While some of the activity measures may be related toproduction volume, other non-production volume related activity measures are also used. The two stage activity basedcosting approach is illustrated in Chapter 7 and focuses on eliminating the distortions that tend to occur when the traditional two stage approach is used. Activity-Based Costing (ABC) represents a significant evolution in cost allocation methods, particularly suited for organizations with diverse and complex operations.

How to Identify and Classify Direct Expenses

In addition to allocating costs for inventory purposes, management needs accurate cost allocations for a make or buy decision. The company has always generated its’ own electric power since the plant was built in a rather isolated area of the northwest. However, a new public utility has recently offered to provide electric power to the plant for 4.5 cents per kilowatt hour.

Cost Allocation and Indirect Cost Rate Frequently Asked Questions

These costs form a portion of the overhead cost of production, which is then allocated to inventory and the cost of goods sold. This method provides a better picture of how costs are incurred, but requires more accounting effort. It also tends to delay the recognition of expenses until a later period, when some portion of the produced goods are sold.

How Liam Passed His CPA Exams by Tweaking His Study Process

Freight charges are commonly taken to exclude transportation costs involved in carrying raw materials to the respective production sites. This is because such costs will depend on factors like distance, weight, and the mode of transport employed, among others, and they are crucial in fulfilling the requirements for materials to produce the final product. Direct expenses are costs that can be attributed to processing a specific good or service.

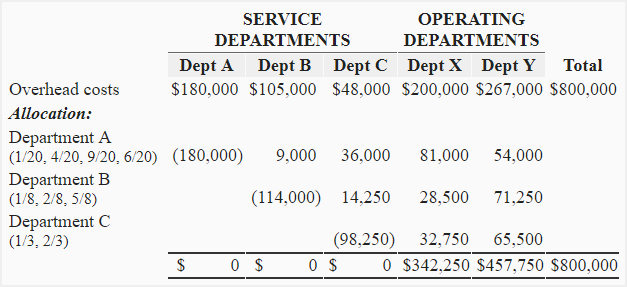

- A second method, frequently referred to as the traditional two stage allocation approach, recognizes that there are service areas and producing areas in the plant.

- For instance, if a factory’s costs are primarily driven by machine operations, then ‘machine hours’ might be an appropriate cost driver.

- He or she might logically argue that the dual rate method illustratedabove assigns the Power Department’s idle capacity costs to the Assembly Department.

- This process often involves using cost drivers, which are factors that cause changes in the cost of an activity.

For example, a quarterly review meeting where financial managers explain the allocation bases and any adjustments can demystify the process and encourage collaborative problem-solving. Another critical aspect of cost allocation in shared services is the need for regular reviews and adjustments. As organizational needs and service usage patterns evolve, the initial allocation bases may no longer be appropriate. iobit start menu 8 for windows 8 free download Regularly reviewing and updating these bases ensures that cost allocation remains fair and reflective of current realities. For example, if a company undergoes a significant restructuring, the allocation of HR services might need to be adjusted to account for changes in employee distribution across departments. This dynamic approach helps maintain the relevance and accuracy of cost allocation over time.

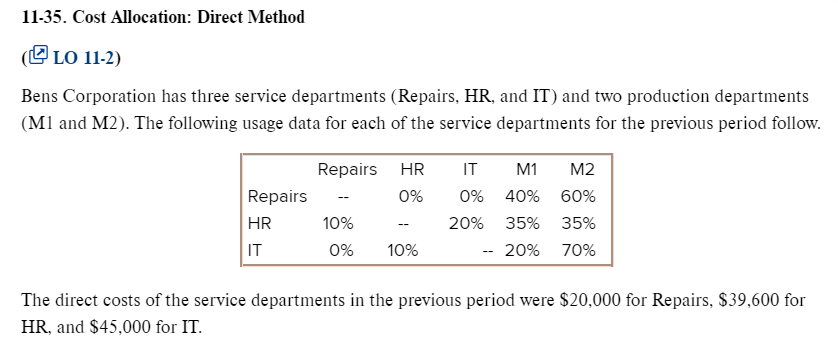

The Direct Allocation Method in Cost Accounting

Therefore, it is essential that decision-makers view cost allocation as not just a financial concern but a critical aspect of their CSR and sustainability efforts. Moreover, cost allocation decisions have a bearing on the company’s external communication as well. Specifically, when it comes to issuing sustainability reports, the allocation of costs provides an explicit representation of the company’s commitment to sustainable practices. In response to this, some firms might opt to use variable costing as a supplement, which includes only those costs that change with production volume. This can provide a more relevant basis for operational and tactical decision-making. So according to the direct allocation method, the cost per unit of Product A is $62.50, and the cost per unit of Product B is $250.

Direct costs manifest uniquely across various industries, reflecting the diverse nature of production and service delivery. In the manufacturing sector, direct costs are predominantly tied to raw materials and labor. For instance, in the automotive industry, the cost of steel, rubber, and electronic components, along with the wages of assembly line workers, form the bulk of direct expenses. These costs are meticulously tracked to ensure that each vehicle’s production cost is accurately calculated, aiding in pricing and profitability analysis. In every business, there are fundamental costs known as direct expenses and they relate directly to the manufacture of goods or provision of services.

Commence with a comprehensive list of all costs that bear a direct relationship with the production. This includes raw materials, production labor, and or any other materials that go into making the finished product or services. This includes both direct and indirect expenses, as well as fixed or variable costs. The principle of ‘benefits received’ posits that costs should be shared among departments or units depending on the extent to which they benefit from the cost pool.

In contrast, ABC ensures that overheads are allocated based on actual resource usage, providing a more accurate picture of product costs. This accuracy is crucial for pricing decisions, product mix optimization, and profitability analysis. For example, a company might discover through ABC that a seemingly profitable product is actually a loss-maker once all relevant overheads are accurately allocated. Departmental rates based on machine hours would provide accurate product costs.b. A plant wide rate based on machine hours would provide accurate product costs.c.